THANK YOU FOR SUBSCRIBING

Editor's Pick (1 - 4 of 8)

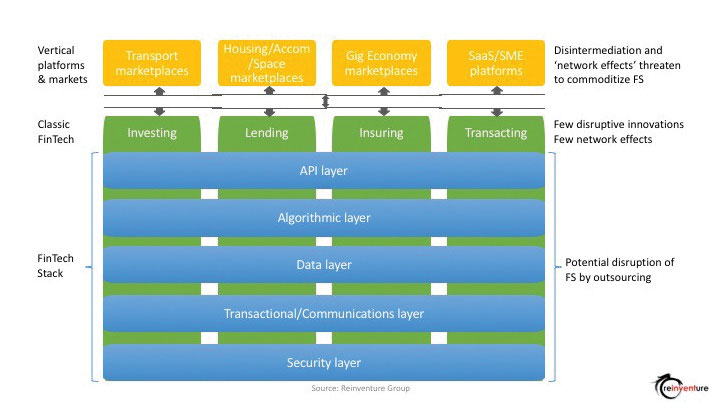

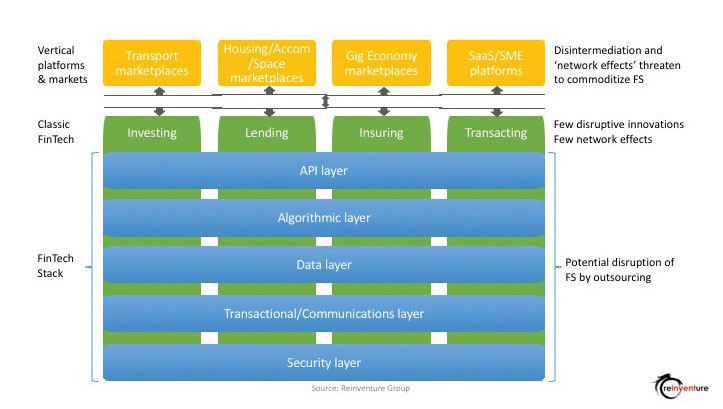

Where is the Real Threat for Financial Services?

Simon Cant, Co-Founder & Managing Director, Reinventure

Simon Cant, Co-Founder & Managing Director, Reinventure

Often, Fintech Ventures Are Able To Get A Jump On Incumbents Because They Are More Consumer-Centric And Agile In Building Out These Products